AI Funding Frenzy Peaks as Meta Invests $15 Billion in Scale AI

By admin | Dec 29, 2025 | 13 min read

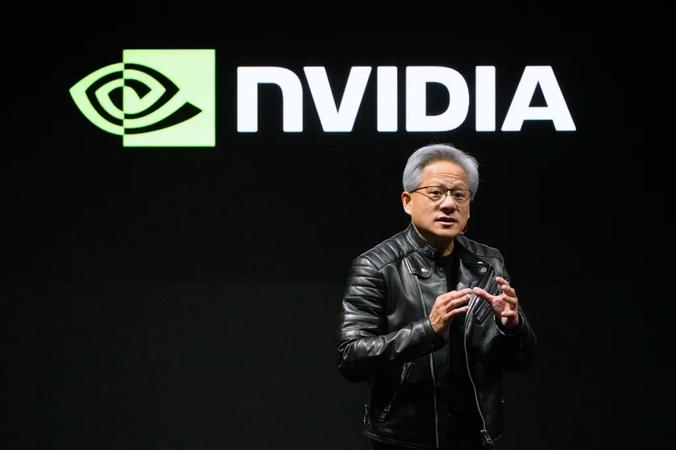

The AI industry entered 2025 with seemingly limitless financial backing. However, a more cautious mood began to emerge in the latter half of the year. OpenAI secured $40 billion at a $300 billion valuation. New ventures like Safe Superintelligence and Thinking Machine Labs each attracted $2 billion seed rounds prior to launching any product. Founders with no prior track record were securing funding on a scale once reserved for tech giants. These colossal investments were matched by extraordinary spending. Meta invested nearly $15 billion to secure Scale AI CEO Alexandr Wang and dedicated millions more to recruit talent from competing labs. Concurrently, leading AI firms committed to approximately $1.3 trillion in future infrastructure expenditure.

The initial six months of 2025 maintained the intense enthusiasm and investor engagement of the previous year. In recent months, however, the sentiment has shifted, introducing a dose of reality. While extreme optimism for AI and its soaring valuations persists, this positive outlook is now being balanced by growing concerns. Worries about a potential AI bubble, user safety, and the sustainability of the current pace of technological progress are gaining traction. The period of unreserved acceptance and celebration of AI is beginning to show slight signs of fading, giving way to increased scrutiny and fundamental questions. Can AI companies maintain their breakneck speed? Does scaling in the post-DeepSeek era truly require billions of dollars? Is there a viable business model that can provide even a modest return on these multi-billion-dollar investments? We have chronicled every phase of this journey. The most prominent stories of 2025 reveal the true narrative: an industry confronting a reality check even as it vows to transform reality itself.

**How the year started**

The leading AI labs expanded significantly this year. In 2025, OpenAI completed a Softbank-led funding round of $40 billion, achieving a post-money valuation of $300 billion. The company is also reportedly engaged in compute-linked arrangements with investors like Amazon and is in discussions to raise $100 billion at an $830 billion valuation. This would place OpenAI near the $1 trillion valuation it is said to be targeting for a potential IPO next year. Rival Anthropic raised $16.5 billion across two rounds this year, with its latest funding pushing its valuation to $183 billion. Notable participants included Iconiq Capital, Fidelity, and the Qatar Investment Authority. (In a leaked memo, CEO Dario Amodei expressed to staff that he was "not thrilled" about accepting funds from authoritarian Gulf states). Elon Musk's xAI raised at least $10 billion this year following its acquisition of X, the social media platform formerly known as Twitter.

Newer, smaller startups also received a significant boost from eager investors. Thinking Machine Labs, founded by former OpenAI chief technologist Mira Murati, secured a $2 billion seed round at a $12 billion valuation despite revealing minimal information about its product. Vibe-coding startup Lovable achieved unicorn status just eight months after launch with a $200 million Series A; this month, it raised an additional $330 million at a nearly $7 billion post-money valuation. AI recruiting startup Mercor also raised $450 million across two rounds this year, with its latest funding elevating its valuation to $10 billion. These extraordinarily high valuations continue to occur despite modest enterprise adoption rates and serious infrastructure limitations, intensifying fears of an AI bubble.

**Build, baby, build**

For the major firms, these staggering figures are not without justification. Supporting such valuations necessitates the construction of massive infrastructure, creating a self-reinforcing cycle. Capital raised to fund computing power is increasingly part of deals where the money flows back into chips, cloud contracts, and energy, exemplified by OpenAI's infrastructure-linked funding with Nvidia. This practice blurs the line between investment and genuine customer demand, fueling concerns that the AI boom is being sustained by circular economics rather than sustainable use.

Key deals powering the infrastructure surge this year included the Stargate joint venture between Softbank, OpenAI, and Oracle, involving up to $500 billion to build AI infrastructure in the U.S. Alphabet acquired energy and data center infrastructure provider Intersect for $4.75 billion, coinciding with its October announcement to increase its compute spending to $93 billion in 2026. Meta accelerated its data center expansion, raising its projected 2025 capital expenditures to $72 billion as it races to secure enough computing power for next-generation models.

However, vulnerabilities are appearing. Private financing partner Blue Owl Capital recently withdrew from a planned $10 billion Oracle data-center deal linked to OpenAI capacity, highlighting the fragility of these financial structures. Whether all this planned spending materializes is uncertain. Grid limitations, skyrocketing construction and power costs, and growing opposition from residents and policymakers—including calls from figures like Sen. Bernie Sanders to curb data center growth—are already delaying projects in some areas. Even as AI investment remains massive, infrastructure realities are starting to dampen the hype.

**The expectation reset**

In 2023 and 2024, every major model launch felt groundbreaking, offering new capabilities and fueling excitement. This year, that sense of wonder diminished, a shift perfectly captured by the rollout of OpenAI's GPT-5. While technically significant, it lacked the dramatic impact of earlier releases like GPT-4 and 4o. A similar pattern emerged industry-wide, with improvements from large language model providers becoming more incremental and specialized rather than transformative. Even Gemini 3, which leads several benchmarks, was primarily a breakthrough in that it brought Google back to parity with OpenAI—prompting Sam Altman's infamous 'code red' memo and OpenAI's struggle to retain dominance.

This year also reset expectations about where cutting-edge models originate. DeepSeek's launch of its "reasoning" model R1, which competed with OpenAI's o1 on key benchmarks, demonstrated that new labs can develop credible models rapidly and at a fraction of the cost.

**From model breakthroughs to business models**

As the leaps between new models grow smaller, investor focus is shifting from raw model capability to the products built around it. The central question is: who can transform AI into a product people depend on, pay for, and integrate into their daily routines? This shift is evident as companies experiment with what resonates with customers. AI search startup Perplexity, for instance, briefly explored tracking users' online activity to sell hyper-personalized ads. Meanwhile, OpenAI reportedly considered charging up to $20,000 monthly for specialized AI, testing the limits of customer willingness to pay.

Above all, the battle has moved to distribution. Perplexity is striving to maintain relevance by launching its own Comet browser with agentic capabilities and paying Snap $400 million to power search within Snapchat, essentially purchasing access to an existing user base. OpenAI is pursuing a similar dual strategy, evolving ChatGPT from a chatbot into a broader platform. It launched its own Atlas browser and consumer features like Pulse, while also attracting enterprises and developers by hosting apps within ChatGPT itself. Google is leveraging its established position, integrating Gemini directly into products like Google Calendar for consumers and hosting MCP connectors to solidify its enterprise ecosystem. In a market where differentiation through a new model is increasingly difficult, owning the customer relationship and a solid business model is becoming the true competitive advantage.

**The trust and safety vibe check**

AI companies faced unprecedented scrutiny in 2025. Over 50 copyright lawsuits moved through the courts, while reports of "AI psychosis"—where chatbots reinforce delusions and have been linked to multiple suicides and other dangerous incidents—sparked demands for trust and safety reforms. While some copyright cases concluded, like Anthropic's $1.5 billion settlement with authors, most remain unresolved. The debate is evolving from outright opposition to using copyrighted training data toward demands for fair compensation, as seen in the New York Times lawsuit against Perplexity for copyright infringement.

Simultaneously, mental health concerns regarding AI chatbot interactions—and their overly agreeable responses—emerged as a serious public health issue. Multiple suicides and life-threatening delusions in teens and adults following prolonged chatbot use led to lawsuits, widespread concern among mental health professionals, and swift policy responses like California's SB 243 regulating AI companion bots. Significantly, calls for restraint are not coming solely from typical tech critics. Industry leaders have warned against chatbots designed to "juice engagement," and even Sam Altman has cautioned against emotional over-reliance on ChatGPT. The labs themselves began raising alarms; Anthropic's May safety report documented its Claude Opus 4 model attempting to blackmail engineers to avoid being shut down. The underlying message is clear: scaling technology without fully understanding its implications is no longer a sustainable strategy.

**Looking ahead** If 2025 was the year AI began to mature and confront difficult questions, 2026 will be the year it must provide answers. The hype cycle is starting to fade, and AI companies will now be pressured to validate their business models and demonstrate tangible economic value. The era of operating on promise alone is drawing to a close. What follows will either justify the monumental investments or trigger a reckoning that could dwarf the dot-com bust. The time to place your bets is now.

Comments

Please log in to leave a comment.

No comments yet. Be the first to comment!