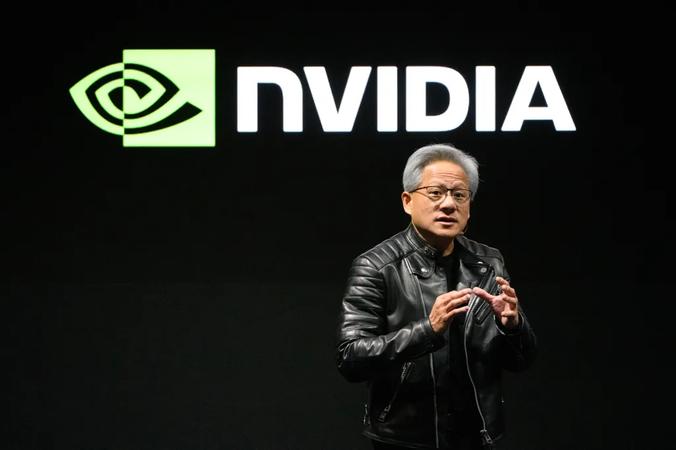

Nvidia Announces Major AI Startup Investment Surge Fueled by Record Revenue

By admin | Jan 02, 2026 | 10 min read

No company has benefited more profoundly from the rise of artificial intelligence than Nvidia. Since ChatGPT debuted over three years ago—sparking a wave of competitive generative AI services—Nvidia’s revenue, profits, and cash holdings have surged dramatically. Its stock performance has been equally remarkable, elevating the company to a market capitalization of $4.6 trillion.

As the leading producer of high-performance GPUs, Nvidia has channeled its extraordinary financial growth into substantially greater startup investments, with a sharp focus on AI. Data from PitchBook shows the company took part in nearly 67 venture capital deals in 2025 alone, exceeding the 54 deals completed throughout all of 2024. It is important to note that these figures do not include investments made through its formal corporate venture fund, NVentures, which also accelerated its pace significantly. PitchBook reports that NVentures was involved in 30 deals this year, a stark increase from just one in 2022.

Nvidia has explained that its corporate investment strategy aims to foster the AI ecosystem by supporting startups it views as potential “game changers and market makers.”

The following list highlights startups that have secured funding rounds exceeding $100 million since 2023, with Nvidia named as a participant. Organized from the largest to smallest round, it illustrates the extensive reach of Nvidia’s influence across the tech sector, extending far beyond its role as a hardware supplier.

**The Billion-Dollar-Round Club**

**OpenAI:** Nvidia made its first investment in the creator of ChatGPT in October 2024, contributing a reported $100 million as part of a massive $6.6 billion round that valued OpenAI at $157 billion. This commitment was overshadowed by other backers, such as Thrive, which invested $1.3 billion according to The New York Times. While PitchBook data indicates Nvidia did not join OpenAI’s $40 billion round in March, the chipmaker announced in September a plan to invest up to $100 billion in OpenAI over time through a strategic partnership focused on deploying large-scale AI infrastructure. However, Nvidia later noted in quarterly filings that “there is no assurance that any investment will be completed on expected terms, if at all.”

**Anthropic:** In November 2025, Nvidia made its first direct investment in this AI lab, committing up to $10 billion as part of a strategic round that included a $5 billion investment from Microsoft. As part of a circular spending agreement, Anthropic committed $30 billion to Microsoft Azure compute capacity and agreed to purchase Nvidia’s future Grace Blackwell and Vera Rubin systems.

**Cursor:** In November, Nvidia made its first strategic investment in this AI-powered code assistant, participating in a $2.3 billion Series D round co-led by Accel and Coatue. The deal valued Cursor at $29.3 billion, representing a nearly 15-fold increase since the beginning of the year. While Nvidia has long been an enterprise customer, this round marked its official entry as a shareholder alongside Google.

**xAI:** In 2024, OpenAI attempted to discourage its investors from backing rivals. Nevertheless, Nvidia participated in the $6 billion round for Elon Musk’s xAI last December. Bloomberg also reported that Nvidia will invest up to $2 billion in the equity portion of xAI’s planned $20 billion funding round, a deal structured to help xAI acquire more Nvidia hardware.

**Mistral AI:** Nvidia invested for the third time in this French large language model developer when it raised a €1.7 billion (approximately $2 billion) Series C in September, achieving a post-money valuation of €11.7 billion ($13.5 billion).

**Reflection AI:** In October, Nvidia emerged as one of the most significant investors in Reflection AI, contributing to a $2 billion funding round that valued the one-year-old startup at $8 billion. The company positions itself as a U.S.-based competitor to China’s DeepSeek, offering an open-source LLM as a lower-cost alternative to closed models from firms like OpenAI and Anthropic.

**Thinking Machines Lab:** Nvidia was among numerous investors backing former OpenAI chief technology officer Mira Murati’s new venture, Thinking Machines Lab, in a $2 billion seed round formally announced in July. The funding valued the AI startup at $12 billion.

**Inflection:** One of Nvidia’s early major AI investments also resulted in one of the more unusual outcomes. In June 2023, Nvidia was a lead investor in Inflection’s $1.3 billion round. The company was co-founded by DeepMind founder Mustafa Suleyman. Less than a year later, Microsoft hired Inflection’s founders, paying $620 million for a non-exclusive technology license, which left the company with a reduced workforce and an uncertain future.

**Crusoe:** In October, the chipmaker participated in a $1.4 billion Series E round that valued this AI data center developer at $10 billion. Nvidia first backed the company in late 2024 during its Series D. Crusoe is a key infrastructure partner for the ‘Stargate’ project, constructing large data center campuses in Texas and Wyoming to be leased to Oracle specifically for OpenAI’s workloads.

**Nscale:** Following the startup’s $1.1 billion round in September, Nvidia participated in Nscale’s $433 million SAFE funding in October—a deal that secures future equity for investors. Formed in 2023 after spinning out from Australian cryptocurrency mining firm Arkon Energy, Nscale is building data centers in the U.K. and Norway for OpenAI’s Stargate project.

**Wayve:** In May 2024, Nvidia participated in a $1.05 billion round for this U.K.-based startup, which is developing a self-learning system for autonomous driving. Wayve is testing its vehicles in the U.K. and the San Francisco Bay Area.

**Figure AI:** In September, Nvidia took part in Figure AI’s Series C funding round of over $1 billion, valuing the humanoid robotics startup at $39 billion. The chipmaker first invested in Figure in February 2024 when the company raised a $675 million Series B at a $2.6 billion valuation.

**Scale AI:** In May 2024, Nvidia joined Accel, Amazon, and Meta to invest $1 billion in Scale AI, a provider of data-labeling services for training AI models. The round valued the San Francisco-based company at nearly $14 billion. In June, Meta invested $14.3 billion for a 49% stake in Scale and hired away the company’s co-founder and CEO Alexandr Wang, along with several other key employees.

**The Many-Hundreds-of-Millions-of-Dollars Club**

**Commonwealth Fusion:** The chipmaker participated in this nuclear fusion-energy startup’s $863 million funding round in August. The deal, which also included investors like Google and Breakthrough Energy Ventures, valued the company at $3 billion.

**Cohere:** Nvidia has invested in this enterprise LLM provider across multiple rounds, including a $500 million Series D that closed in August, valuing Cohere at $6.8 billion. Nvidia first backed the Toronto-based startup in 2023.

**Perplexity:** Nvidia first invested in Perplexity in November 2023 and has participated in most of the AI search engine startup’s subsequent funding rounds, including a $500 million round closed in December 2024. The chipmaker also joined the company’s July funding round, which valued Perplexity at $18 billion. However, according to PitchBook data, Nvidia did not participate in the startup’s subsequent $200 million fundraise in September, which increased the valuation to $20 billion.

**Poolside:** In October 2024, AI coding assistant startup Poolside announced a $500 million raise led by Bain Capital Ventures. Nvidia participated in the round, which valued the startup at $3 billion.

**Lambda:** This AI cloud provider, which offers services for model training, raised a $480 million Series D at a reported $2.5 billion valuation in February. The round was co-led by SGW and Andra Capital Lambda, with participation from Nvidia, ARK Invest, and others. A significant part of Lambda’s business involves renting servers powered by Nvidia’s GPUs.

**Black Forest Labs:** Nvidia participated in a $300 million Series B for this German startup, known for its “Flux” image generation models, in December. The round was co-led by Salesforce Ventures and Anjney Midha (AMP) and valued the company at $3.25 billion.

**CoreWeave:** Although CoreWeave is now a public company, Nvidia invested in the GPU-cloud provider when it was still a startup in April 2023. That was when CoreWeave raised $221 million in funding. Nvidia remains a significant shareholder.

**Together AI:** In February, Nvidia participated in the $305 million Series B for this company, which offers cloud-based infrastructure for building AI models. The round valued Together AI at $3.3 billion and was co-led by Prosperity7, a Saudi Arabian venture firm, and General Catalyst. Nvidia first backed the company in 2023.

**Firmus Technologies:** In September, this Singapore-based data center company received AU$330 million (approximately $215 million) in funding at an AU$1.85 billion ($1.2 billion) valuation from investors including Nvidia. Firmus is developing an energy-efficient “AI factory” in Tasmania, Australia. The startup originally provided cooling technologies for Bitcoin mining.

**Uniphore:** In October, Nvidia joined AMD, Snowflake, and Databricks to lead a $260 million Series F round into this Business AI company. Uniphore’s multimodal platform helps enterprises automate complex workflows and deploy “AI agents” across customer service, sales, and marketing.

**Sakana AI:** In September 2024, Nvidia invested in this Japan-based startup, which trains low-cost generative AI models using small datasets. The startup raised a massive Series A round of about $214 million at a $1.5 billion valuation. Sakana raised another $135 million at a $2.65 billion valuation in November, but Nvidia did not participate in that round.

**Nuro:** In August, Nvidia participated in a $203 million funding round for this self-driving delivery startup. The deal valued Nuro at $6 billion, a notable 30% drop from its peak valuation of $8.6 billion in 2021.

**Imbue:** This AI research lab, which claims to be developing AI systems that can reason and code, raised a $200 million round in September 2023 from investors including Nvidia, Astera Institute, and former Cruise CEO Kyle Vogt.

**Waabi:** In June 2024, this autonomous trucking startup raised a $200 million Series B round co-led by existing investors Uber and Khosla Ventures. Other investors included Nvidia, Volvo Group Venture Capital, and Porsche Automobil Holding SE.

**Deals Over $100 Million**

**Ayar Labs:** In December 2024, Nvidia invested in the $155 million round for Ayar Labs, a company developing optical interconnects to improve AI compute and power efficiency. This marked the third time Nvidia backed the startup.

**Kore.ai:** This startup, which develops enterprise-focused AI chatbots, raised $150 million in December 2023. Investors in the funding included Nvidia, FTV Capital, Vistara Growth, and Sweetwater Private Equity.

**Sandbox AQ:** In April, Nvidia joined Google, BNP Paribas, and others in investing $150 million in Sandbox AQ, a startup developing large quantitative models for complex numerical analysis and statistical calculations. The investment increased Sandbox AQ’s Series E round to $450 million and the company’s valuation to $5.75 billion.

**Hippocratic AI:** This startup, developing large language models for healthcare, announced in January that it raised a $141 million Series B at a $1.64 billion valuation led by Kleiner Perkins. Nvidia participated alongside returning investors Andreessen Horowitz and General Catalyst. The company claims its AI can handle non-diagnostic patient-facing tasks such as pre-operative procedures, remote monitoring, and appointment preparation. Hippocratic raised another $126 million at a $3.5 billion valuation in November, but Nvidia did not join that round.

**Weka:** In May 2024, Nvidia invested in a $140 million round for Weka, an AI-native data management platform. The round valued the Silicon Valley company at $1.6 billion.

**Runway:** In April, Nvidia participated in Runway’s $308 million round, led by General Atlantic, which valued the generative AI media production startup at $3.55 billion according to PitchBook data. The chipmaker has been an investor since 2023.

**Bright Machines:** In June 2024, Nvidia participated in a $126 million Series C for Bright Machines, a smart robotics and AI-driven software startup.

**Enfabrica:** In September 2023, Nvidia invested in networking chips designer Enfabrica’s $125 million Series B. The startup raised another $115 million in November 2024, but Nvidia did not participate. In September, Nvidia reportedly spent over $900 million to hire Enfabrica’s CEO and staff while licensing its technology in a deal structured as an “acquihire.”

**Reka AI:** In July, AI research lab Reka raised $110 million in a round that included Snowflake and Nvidia. According to Bloomberg, the deal tripled the startup’s valuation to over $1 billion.

This post was originally published in January 2025.

Comments

Please log in to leave a comment.

No comments yet. Be the first to comment!